|

| Today's post highlights the effects of inflation on the US economy in the past decade and a half. Fun! |

I went back home for a weekend recently, and as I'm sure is a common occurrence for many, came away with some old odds and ends my mom found while cleaning and reorganizing that had been tucked away in some closet somewhere. Sentimental at heart (note that there is a fine line between "sentimental" and "hoarder") and always reluctant to throw things away, naturally I brought the items back with me to my apartment. Not that I had seen any of them in quite some time, but one of the items in particular was one that hadn't crossed my mind in years: my old second grade science project. This was not the tri-fold cardboard display exhibited at the science fair -- only the little booklet that went with it -- but still, it brought back a lot of memories.

Young Retail Retell, it turns out, was just as much of a nerd as his older, more tired counterpart. Long before he ever dreamed or even heard of starting a flickr page or running a blog on which to share supermarket photographs, history, and research, as an eight-year-old he dragged his parents to three different grocery stores on three consecutive Fridays to compare prices and see which store was cheapest. Even back then, I was fascinated by brands, logos, and stores: no one can say I'm not consistent! The project, titled "Spend a Little, Spend a Lot," was the result. Check it out below:

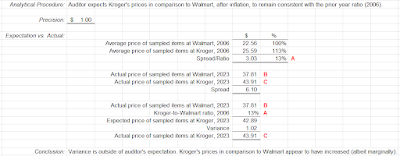

We start with the page summarizing the entire project from start to finish. To summarize the summary, the gist of the project was to see which local grocery chain -- Walmart (which, you'll notice, I stylized even in my own handwriting with the star logo; that's dedication right there), Kroger, or Schnucks (RIP) -- had the lowest prices over that three-week period in January 2006 (a mere 17 years ago...). I anticipated Walmart would come out on top, and while the sale prices at the other two sometimes did win out, Walmart was cheapest overall.

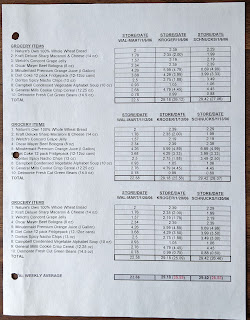

Backing up my summary was the actual data page, showing the comparison by item, store, and date (with sale prices in parentheses next to the regular prices at Kroger and Schnucks). I compared 10 items at each store, many of which (as you might can imagine) were influenced by some of my favorite groceries:

- Nature's Own 100% Whole Wheat Bread

- Kraft Deluxe Sharp Macaroni & Cheese (14 oz) -- sadly, this one disappeared from Walmart and Kroger shelves more than a decade ago...

- Welch's Concord Grape Jelly

- Oscar Mayer Beef Bologna (8 oz)

- Minute Maid Premium Orange Juice (1 gal) -- surprised I went with the regular; even today I unashamedly buy the "kids" variety

- Diet Coke 12-pack cans

- Doritos Spicy Nacho Chips (13 oz) -- spicy >>> regular

- Campbell Condensed Vegetable Alphabet Soup (10 oz)

- General Mills Cookie Crisp Cereal (12.25 oz)

- Del Monte Fresh Cut Green Beans (14.5 oz) -- I did always like my vegetables

The total weekly average is shown at the bottom of the data page, and presented in visual format on this nifty little Microsoft Excel graph page, too (ah, the wonders of modern technology!). You can see Walmart was the lowest at $22.56. Kroger, inclusive of its sale prices, came in $3.03 higher, at $25.59. For its part, Schnucks averaged $26.53 with sale prices, but at regular prices, Kroger and Schnucks were only pennies apart (albeit both nearly $7 more than Walmart's "everyday low prices").

For fun... and because I'm a weirdo who actually considers such a thing to be "fun"... I decided it would be neat to reperform this experiment in 2023, and see how the prices compare now to back then. Would the results remain similar? Is Walmart still the cheapest? How much have prices gone up?

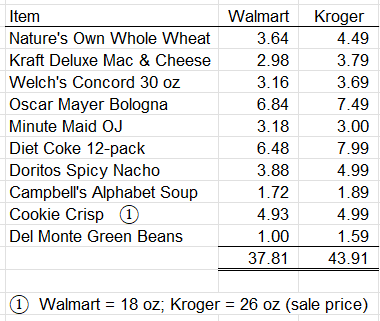

To make the process simpler (and because I sure as heck am not going to spend as much time on this part of the ordeal, even though one could argue this blog post in total is more time than I spent on the entire original project...), I opted to take the "quick and dirty" route for my 2023 price comparison. First of all, Schnucks left the Mid-South in 2011, so there's one competitor down. For Walmart and Kroger, I simply opened up their apps on my phone (on Monday, October 16, 2023) and looked up the prices that way. Some items, it should be noted, aren't available locally here in Ridgeland and/or anymore at Walmart or Kroger, so I've selected the next closest substitute as necessary. (It would also be an interesting commentary to analyze how product sizes have changed, but that's beyond the scope of this particular exercise.) Finally, on the Kroger side of things, I've collected only sale prices -- not bothering with regular prices this time around. Below, my results:

As you can see, Kroger in some instances still has sale prices better than Walmart (notably the Cookie Crisp, which -- because the two stores now sell different-sized packages -- nets you 8 more ounces for only 6 more cents), but Kroger still loses overall with a total price of $43.91 as compared to Walmart's $37.81 (a difference of $6.10).

What do these results tell us? Read on to find out...

--------------------------------------------------

As a student who never particularly enjoyed his science classes, it pains me to come to this realization, but a science fair project isn't all that different, fundamentally speaking, from an audit. For those of you who weren't already aware from past information I've shared about my life on flickr and my blog, these days I am a licensed CPA working as an independent external auditor. In a science experiment, you derive a hypothesis and then perform certain tests to confirm whether or not the evidence that you collect actually supports that hypothesis as being true, or outs it as being false. In an audit, the company we are auditing is making representations about its financial standing at a specific point in time and its financial performance over a specific period of time (leading up to that specific point). As auditors, we come in and gather evidence to determine, within a degree of reasonable (but not absolute!) certainty, whether or not management's assertions appear correct. In a science experiment, the end result is a conclusion on what the procedures performed reveal about the initial hypothesis. In my line of work, the deliverable is our evidence-based independent auditors' opinion on the company's financial statements. In principle (if not in practice), not too dissimilar, all things considered.

Looking closer, an analytical procedure holds even more of a resemblance to a science fair project. Analytical procedures are one specific type of test that auditors use, and really don't provide actually much concrete evidence at all; they are not considered to be a substantive test, which involves obtaining actual physical evidence to support the numbers (or whatever other assertion[s]) we're looking at. Instead, the main evidence that analytical procedures provide is simply an assessment of reasonableness, basically as if it's a smell test... does the actual outcome that we're seeing look more or less like it is correct, given what we'd estimate the same outcome to be based on past knowledge (which we still expect to hold true) and current trends (whose impact on our past knowledge we can appropriately account for)? Or, does the actual outcome smell a little fishy, as if there are some other factors impacting it that warrant some further digging? Recognizing that reliance on analytical procedures alone does not provide the same form of obvious substantial audit evidence as other, more involved tests, they nonetheless can give us comfort over something that feels like it looks reasonably okay, or point us in the direction of something that may need a little more attention.

So. If the analytical procedure is intended to test for reasonableness, then "precision" is the metric that we use to define what we consider to be within the realm of reason. Precision is typically expressed as a dollar amount, and most commonly as some form of materiality. "Materiality" is what auditors use to judge what matters. What matters to me -- in many senses, not just monetarily! -- might not matter to you. Likewise, as an explicit monetary illustration, $500 might not matter much at all to some big insurance conglomerate, but it might matter a heck of a lot to that small nonprofit organization down the street. In an analytical procedure we are looking to see if the actual results that we encounter make sense in comparison to the expected results that we calculate, and look to explain any difference, or "variance," between the two. If the variance is small enough to be below our stated precision -- that is, deemed "immaterial" -- we accept the results as "within expectation," and move on with our lives. Any variances that are outside of auditor expectation invite further investigation.

Let's all put our auditor hats on, on top of our second grade science fair beanies we're already wearing (all complete with little propellors, of course!), for this next bit. We know what the results of my experiment were in 2006. We also know what the results are for 2023. Going to our trusty friend Mr. Internet, we can obtain independent external evidence on what effects inflation has had on the US economy as a whole over those 17 years. Using that information, we can derive an auditor's expectation -- form a hypothesis -- of what we think the Walmart and Kroger prices should be. And finally, when we perform our test to compare those "should be" prices to the prices that actually are, we can evaluate and conclude on whether the difference is immaterial (the increase is due exclusively to inflation) or whether there are other factors at play (Walmart and Kroger have raised their prices beyond the normal inflation amounts).

Not the type of blog post you expected to jump into, is it?

--------------------------------------------------

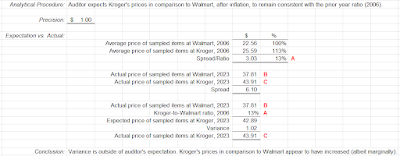

Since they've been proven twice over to be the cheapest, with all others looked at in comparison to their baseline prices, we'll continue to use Walmart as the basis for our analysis, as the certified Low Price Leader™. (Actually, that tagline belonged to Fred's, but they don't exist anymore. Their auditors were right to give them a going concern opinion in 2018.) For materiality purposes, since this procedure is relying highly on small dollars and cents, let's say anything more than $1.00 will be outside of our expectation.

We'll begin by gathering some evidence on inflation. According to the website

Carbon Collective, the total inflation rate between 2006 and 2023 is 49.23%. This is calculated by taking the difference between the Consumer Price Index (CPI) in 2023, which is 300.84, and in 2006, which was 201.6, and converting to a percentage, as follows:

From this, we can reasonably say that, all else held equal, we would expect Walmart's prices to have gone up by approximately 49 percent due to inflation. Any increase much more than that amount would suggest that consumers are paying comparatively more than they did in 2006 for the same (or similar) items. Let's see:

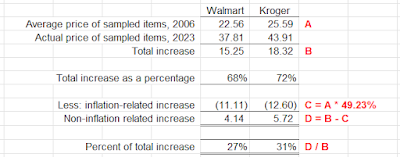

An inflation-related increase of 49% on Walmart's 2006 prices would lead us to expect that the 2023 prices should be around $33.67. However, the actual prices we are witnessing total $4.14 greater than that, which exceeds the $1.00 wiggle room we set for ourselves. Therefore, of Walmart's total 2006-to-2023 price increase of $15.25, approximately 27 percent is due to factors other than inflation.

We could analyze Kroger in the same way, but at the Kroger level there are not one but two factors at play. First is the basic inflation factor, like we just saw with Walmart. But second is the competition factor: that is, has Kroger maintained the same ratio of cost competitiveness with Walmart that it had back in 2006? Has it narrowed the margin and gotten closer to Walmart's prices? Or has it become even more expensive than Walmart than it was 17 years ago? Let's take a look.

As it turns out, Kroger is basically just as competitive with Walmart as it was 17 years ago. In the analysis above, we determined that Kroger's prices were approximately 13 percent greater than Walmart's back in 2006. We would expect that ratio to remain consistent, even after inflation. So, taking Walmart's present-day 2023 prices and increasing those by 13 percent allegedly should get us somewhere close to Kroger's present-day 2023 prices. Indeed, we find that Kroger's 2023 prices of $43.91 are a mere $1.02 greater than our calculated expectation of $42.89. Technically, that is two cents outside of our precision, and it really depends on how you look at it: percentage-wise, it's a 16 percent ratio as opposed to 13 percent, which is a 23 percent increase (3 percent change divided by the original 13 percent ratio). But ultimately, regardless of the percentages, $1.02 really doesn't make a whole lot of difference to my wallet (your results may vary). I still feel comfortable in saying Kroger hasn't become noticeably more relaxed -- and certainly it hasn't gone the other direction and gotten any more aggressive! -- in its competitive stance with Walmart. Whether or not it's a good thing, though, that this status quo has been left more or less in place, eroding only slightly -- is left up to you, the consumer, to decide!

Above is a final summary of the 2023 results. Prices at Walmart increased 68 percent between 2006 and 2023 on our sampled grocery items, approximately 27 percent of which appears to be related to factors other than inflation. At Kroger, (sale) prices jumped 72 percent, 31 percent of which seems non-inflation related. Although not shown in this summary, as noted previously, the ratio of Kroger's prices to Walmart's prices still remains mostly consistent, having slipped just a marginal amount into more expensive territory.

Remember that all of this is a very simplified analysis, and we're not doing any actual further research to determine the truth of what all we just looked at. For instance, we are assuming that profit margins are what's causing the difference -- that is, that the increase in Walmart's and Kroger's prices not accounted for by inflation is simply going straight into their pockets as profit. That may very well be untrue. Profit margins for the retailers may well be unchanged, and there are other factors we are not seeing -- inflation-related, or otherwise -- on the manufacturers' and suppliers' side of things that have caused the additional increase in Walmart's and Kroger's prices. Without gathering tons more evidence -- a lot of which probably isn't even publicly accessible -- and going much more in-depth, we have no way of knowing with absolute certainty. But again... given the limitations and constraints of this particular experiment... we can at least conclude that 1) there definitely appears to be more than just inflation at play in these price increases, and 2) the result of that, absent any evidence to the contrary, is that consumers appear to be giving up more out of their pocket for the same items in 2023 than they did in 2006.

--------------------------------------------------

I was originally intending to write a considerably different blog post today, one that, oh, I don't know, actually involves pictures I took of some retail place in the past, and certainly zero references to my education or my profession (!)... but, clearly, I got sidetracked :P Even if a lot of this went over your head, I hope you still found the post enjoyable! And if not, well, please accept my apologies, lol. Hopefully I'll be back next month with something a bit more up your alley. Until then and as always, thanks for reading, and have fun exploring the retail world wherever you are!

Retail Retell

Interesting stuff! I’m not sure if everyone will like the subject of this post, but given how I’ve e-mailed you supermarket price comparison spreadsheets before, you know that I would be interested in this subject! I even fired up a spreadsheet myself (LibreOffice!) to play along at home!

ReplyDeleteFirst, I find it rather remarkable that you were in the second grade in 2006! At the time, I was working in a social science research lab at a university where I was helping with quantitative research. So, yeah, all the more reason to like the subject of today’s post! Granted, what I do today is quite different, but you never entirely lose quantitative curiosity!

I’m also impressed with your handwriting as a second grader. I really don’t remember what my writing was like at that time, but my handwriting today, or from 2006, is not something I would post online! It would barely be legible! Also, I find it interesting that you used the star in the Wal*Mart name! Surely this was a sign that you were, and would continue to be, a retail enthusiast!

So, as far as me playing along at home, I searched your Kroger 2023 shopping list at the Kroger website, but using a Houston location, and I got a total of $41.31. This is with sale prices, but the caveat is that Kroger has all kinds of sales beyond the regular sales. There are digital coupons and volume discounts (‘Buy 5’, etc.). Kroger also mails me paper coupons, often very good ones, on frequently purchased items since apparently Kroger deems me to be a frequent shopper. Lucky me! With that, the price could actually be even less than $41.31, but I think my method is the same as yours so we’ll just go with that.

I agree that we cannot conclude much from the findings without further analysis of things which we probably don’t even have access to such as wholesale prices and so forth. For one, certain parts of the country faced a severe drought this summer, and some had flooding rain, so that might affect prices. In your area, retailers like Schnucks and Fred’s have disappeared and so market consolidation in your area may very well have contributed to increased prices and we also have to factor in market consolidation throughout the whole food production/logistics chain. Also, with things such as digital coupons, it is possible that prices have increased for those who do not use ‘extreme’ modern discounting methods to compensate for those who do use those methods. It is hard to say, there are many potential factors to consider.

I seem to remember when assessing Kroger’s prices some months ago that Southaven is cheaper than Ridgeland. I’m not sure where Hernando, if that is where you lived in 2006, measures in comparison. The differences might be more stark on perishables rather than center-store items where I think things are less variable. I also seem to remember from my previous price comparisons that prices in MS were about the same, or maybe even more expensive, than Fred Meyer’s prices in Seattle! Granted, I think the biggest differences again were in perishables. The Pacific NW grows a lot of produce and produces a lot of dairy products so perhaps those can be sold for less there than in places where those items have to be transported cross-country.

Of course, the fact that MS is less competitive than, say, Houston and probably even Seattle means Kroger might be subsidizing the competitive areas by increasing prices in less-competitive areas like MS. Now, this would have been an issue in 2006 as well, but it is possible that MS has less options now relative to 2006 than Houston did. Perhaps these results would be different in Houston, but I have no idea what things cost in 2006 to do a comparison of my own.

Anyway, I like these change of pace type retail blog posts and I think this type of research, even if it is basic, is important in chronicling retail history.

Thanks, glad you liked it! I figured you would be interested in the price comparison stuff! I'm honored that you even played your own at-home edition, haha!

DeleteI don't think I've been too shy about my age in the past, but yeah, it does definitely put it in perspective to attach a specific grade to a specific year! I have coworkers now who were born after the new millennium, so that's the latest in "age shockers" for people in my age group, lol.

Thanks -- I was wondering if anyone would comment on my handwriting, haha. I was always told growing up that I had nice handwriting and always appreciated that. These days it's more of a cursive hybrid with it; I still consider it print, but one of my friends who saw it swears it's cursive. Just because I don't lift my pen up after every single letter doesn't mean it's not print!

Yep -- it sounds like you used the same method that I did. I only considered regular sale prices, not any of the digital coupons or other offers. My mom gets those paper coupons in the mail as well, and identical/similar ones appear on the app, too, marked "best customer bonus" or something like that. Somehow, even though we have separate Plus Cards, our accounts on the app are interconnected -- so if, for example, I use one of the digital deals, it disappears (because those are good for one shopping trip only) and she can't use it. Not quite sure how to get those separated -- and anyway, I digress, lol.

Anyway, it doesn't surprise me that your results are different -- like you said, there definitely seem to be some regional variances and those factors could be based on many things including competition, distribution, etc. You are correct that the prices in DeSoto County do seem to be cheaper than here in Madison County. For example, a half-gallon of milk at the Ridgeland Walmart costs $2.17, whereas in Hernando the app says it is $1.82! This is why I only buy milk when Kroger puts it on the digital deal for $1.29! You are also correct that I was living in Hernando in 2006 -- as a matter of fact, bonus fun piece of information, I was part of the last-ever second grade class at Hernando Elementary School. They were building a new school, Hernando Hills Elementary, for second and third graders at the time, and our third grade year was the first to be at the new school. Currently they are building a new high school campus -- Hernando has just kept growing!

I really appreciate you sharing your thoughts on the factors that could be influencing prices besides inflation. I don't have a whole lot of knowledge in that area, but everything you listed sounds 100% plausible and I can easily see one or a combination of those factors playing a role. Regular prices compensating for sale prices and coupons is not one I would have thought of, but makes perfect sense. Likewise, market consolidation from the lack of competitors, as well as less competitive markets like ours subsidizing more competitive markets like yours, is completely logical.

All of that to say -- thanks very much for your input, and yep, even though this definitely isn't the type of retail history I normally document, I'm glad you think it is important!

You accountants and your spreadsheets! :)

ReplyDeleteI'm not surprised that Walmart's prices are increasing beyond the rate of inflation. Walmart seems to have become less conscious of being "the low price leader" from what I've seen, and some of their prices (at least in relation to groceries) aren't much different than the competition (at least around here). As competition has eroded, Walmart has been increasing prices on grocery items. I've also heard that Walmart tends to be cheaper in areas where Kroger is present, as Kroger can actually give Walmart a run for their money due to their size and relative financial stability.

I figured the results of your study would be a bit depressing comparing prices between 2006 and now. Even some things I would buy for 99 cents just about a year ago are now going for $2.09 at the store - crazy! (And that photo you used to start the post with was spot on!) It was interesting to read your analysis on this topic - it almost seems like you were destined to be an auditor from a young age!

Ha -- what can I say, spreadsheets are something we Excel at!

DeleteThanks for sharing your analysis of Walmart's prices in your area -- as Anonymous mentioned above, these things seem to differ quite a bit regionally. I'm a bit surprised that Walmart isn't trying harder to be cheaper in your area where there is more competition around, but then again, maybe it is one of those things where all the competitors choose to charge similar prices and therefore everybody (in theory) can make a little more profit. For instance, I know when Dollar Tree raised prices to $1.25, Walmart and others (can't remember now if it was Target, Kroger, or both) were temporarily cheaper on things like the little Glade-type scent cones at 99 cents. But not long after, they'd all gone up to $1.25, too. To me, that's a case not of the product changing any, but of the retailers trying to squeeze more out of consumers, just because they can. It's interesting that that is the logic there, though, as you'd think the first thought would be to stay cheaper to drive more traffic to their store!

Yep, I'm right there with you on that (thanks for the compliment on the graphic, too, lol) -- and like I mentioned in the post, it would also be very interesting to analyze how product sizes have changed in tandem with all of this, such that not only are we paying more, but we're also getting less! Obviously I don't have enough info to even begin trying to look into that, but I know it is definitely not just something I'm imagining, lol. Anyway, glad you liked the post (and ha, thanks)!

Ha this was a great post. I really enjoyed reading your old homework. I'm in education myself, and what I would tie in is that even though you didn't enjoy science, the subject, the point of the exercise was to push the scientific method. Mitochondria are the powerhouse of the cell, but that doesn't matter when you're a CPA. Knowing how to test a hypothesis and graph its results accurately does, though. I teach a subject where students constantly want to know what relevance the material has to the real world. It's tough to promote the mindset that school is less about the material and more about the strategy. I had a similar project in elementary, where I (with the help of my grandad) tested a hypothesis that different 93-octane gasoline brands would increase mileage. It was for math, which I despised, but because I had an interest in creating a poster board with major gas station logos glued to it, I soldiered through. Also, I have to throw in, that your handwriting was excellent! I teach secondary and have students who write far less legibly than you did in 2nd grade, lol.

ReplyDeleteAs for the inflation side of things, Walmart, as mentioned by AFB has no care to be the low-price leader any longer. Competition is so snuffed out all they need to do is come in a bit cheaper than everyone else, and they'll pull one-stop shoppers. Although, being honest, I do somewhat question how the CPI has handled what I've heard termed in Retail News "greedflation", which seems to be going on in lots of places.

Thanks, glad you liked it! And that's great input, too -- very good point about the method being what matters, not specifically the subject matter. I can imagine that is indeed very tough to get across, and I doubt I'd have realized it very easily, either. But I appreciate your efforts to promote that mindset at your school! Cool to hear you had a similar project when you were younger as well (I'd have loved a poster board like that, haha!) -- do you remember what the results were?

DeleteThanks for the compliment on my handwriting, too! And yeah, that's a huge thing to note -- given how much of my analysis is based on the CPI, just how accurate is the CPI itself?? You're right also on Walmart pulling one-stop shoppers just by being somewhat cheaper than the rest: that's definitely my M.O., anyway. (Not that we have a lot of competition, though, lol.)

This was an interesting post! While I did start to drift with some of the nitty-gritty accounting talk (I felt like I was back in econ class), it's fascinating to compare price data from different stores then and now. I can also understand being sentimental about something, but know that hoarders typically don't consider themselves as such, lol!

ReplyDeleteIt's really funny to see the selection of grocery items—you go from relatively healthy whole wheat bread to bologna! I'm also impressed by the Microsoft Word skills that are presumably courtesy of one of your parents!

Nature's Own 100% Whole Wheat Bread: $4.29

Kraft Deluxe Macaroni & Cheese: $3.79

Welch's Concord Grape Jelly (30 oz): $3.49

Oscar Mayer Beef Bologna $7.95

Simply Orange Juice 62 oz: $3.50 (sale, normally $4.69)

*Publix does not carry Minute Maid OJ, but isn't that typically cheaper than Simply since the latter is not from concentrate?

Diet Coke 12 pk $8.99

Doritos Spicy Nacho 9.5 oz: $5.99 (price on bag)

Campbell's condensed chicken noodle Paw Patrol $1.99 (vegetable soup was cheaper, but Publix does not carry the alphabet soup; I'll guess $1.89 for the vegetable price since I didn't check)

Cookie Crisp Cereal (18 oz): $3.55 (sale, normally $7.09)

Del Monte canned green beans: $1.59

While my comparison is even more flawed that your experiment, I learned a few interesting things on this adventure. First, you sent me on a wild goose chase around Publix to look for stuff I've never dreamed of buying. I typically stick to the perimeter aisles of the store for my shopping but you sent me zig-zagging through the grocery department for sure. Second, for how much I hear about Publix' prices being ridiculous, my total from the above stuff came out to $45.03 (which is only $1.12 more than your Kroger trip). Third, from my unscientific experience, most people shopping at Publix seem to buy the house brand products rather than the national brands. I'd be curious to know if this skews pricing for the national brands in any way to account for a difference in sales volume. The two things I still question on my trip are the orange juice and the Doritos. The only price I found for the chips was just printed on the bag, and I'd be surprised for that to vary across regions. I wonder if Publix' price may be cheaper if I actually bought the bag, but I don't know. All of that is to say that Publix was cheaper than Kroger on many items, but also more expensive on other things. Based on my experiences with Georgia Kroger stores, I will HAPPILY pay an extra $1.12 for the DRASTICALLY more pleasant experience I have at Publix.

As for your handwriting, it does seem more cursive hybrid than most people these days, as you've probably just picked up cursive letters here-and-there like I do on occasion. I personally consider my own writing to be a form of chicken-scratch print, lol.

Another factor in price increases could be new procedures or regulations that cost more money to implement, transportation, etc. As you mentioned, there is a whole host of factors that could lead to the price increases not directly correlating with inflation.

Thanks, glad you enjoyed it! And ha -- not to toot my own horn, but I think the Word skills were probably my own! I've always enjoyed playing around with Microsoft Office products (again: nerd).

DeleteWow, I didn't expect you to play along, haha! Thanks for adding the Publix perspective to this project! I agree with you, I am impressed that Publix's prices aren't that far off from Kroger's. And I can certainly understand your desire to pay that little bit extra to avoid shopping at Kroger. I imagine a lot of folks feel the same way about paying a bit more at Kroger to avoid shopping at Walmart! Personally, I just want the best deal I can get XD

Most of those prices seem to be in the comparable range, but the Cookie Crisp stands out to me -- its sale price is even better than Walmart, which is pretty wild, but its regular price is $2.16 more?! I feel like I could almost buy another different box of cereal for that! I also very much buy into your theory of Publix relying more on their store brand than national brands; the absence of certain name brands like Minute Maid also seems like it supports that idea.

Ha -- thanks for the handwriting compliment! And yep, it's hard to know overall what other factors are playing in, but it definitely feels like it's more than just inflation for sure.

I used to love using the "word art" feature to make different signs and such. I still have a feeling your parents helped you a bit with some of that formatting considering I had an entire semester's class on how to make tables and graphs in Microsoft Word!

DeleteI figured it wouldn't be too hard to play along and I was also curious to find some concrete evidence for the "Publix is more expensive" price debate. I feel like my argument of "it isn't vastly different from Kroger" held true, and it helps that I didn't pick the products either! And if you want the best deal, I'm surprised to hear you don't drive out to Aldi more often (I know people who would go 30 minutes to shop at one to have a cheaper grocery bill). I'm also typically a sucker for finding good deals, but I find Boar's Head's slogan of "compromise elsewhere" to be fitting in this situation, lol.

I can explain part of the Cookie Crisp mystery: most of Publix' sales are centered on BOGOs (they have entire billboards that say something like "BOGOs for days"), but in Georgia, you don't have to buy two items to get the sale price. That essentially means most of Publix' sales are 50% off on items like cereal. So for me, that works out great because I stock up on whichever cereal is on BOGO that week and get a cheaper price per ounce than I'd pay at a wholesale warehouse like Sam's or Costco! The same item also tends to be on sale every few weeks, so stocking up isn't really a big deal. Maybe the cheaper sale prices compensate for the higher normal prices? It also seems like Publix' orange juice is concentrated around Tropicana, Florida's Natural, and Simply—since Florida is such a big state for orange juice, I wonder if Minute Maid isn't as popular there.